Post the inconclusive merger talks with Kioxia, Western Digital has declared plans to separate into two distinct publicly traded entities, focusing on hard drives and flash memory. This division, endorsed by Western Digital's Board of Directors, is projected for completion as a tax-neutral transaction in the second half of 2024.

A recent quarterly report highlighted a 26% revenue decline for Western Digital year-over-year, driven by a reduced demand for both product categories. The proposed bifurcation aims at allowing both entities to better streamline their value propositions. Elliott Management, an investor holding close to $1 billion in Western Digital shares, had previously proposed such a division. Subsequent to the split's announcement, there was an 8% uptick in Western Digital's stock value. It should be mentioned that the merger discussions between Western Digital and Kioxia were not favored by SK hynix, a South Korean competitor, or Bain Capital, Kioxia's main shareholder.

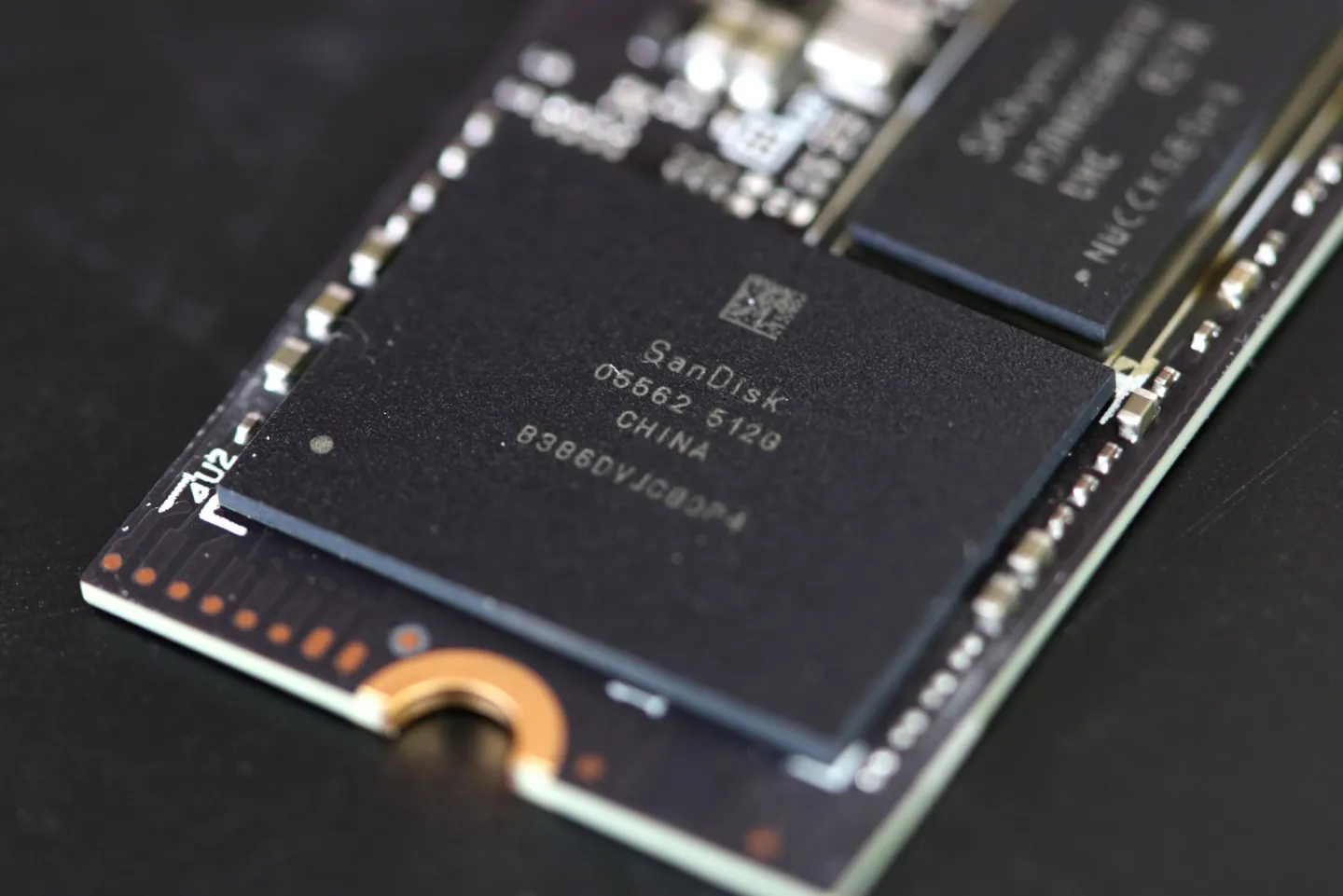

A successful merger would have secured a third of the memory market share for the combined entity, posing competition to dominant players like Samsung Electronics and SK Hynix. Since 2021, Western Digital and its manufacturing partner Kioxia have been in talks for a merger that would create a company that controls a third of the global NAND flash market.

Source: Reuters