Good news if you are planning to purchase some SSD storage later this year, the ongoing drop in prices for NAND is just that, ongoing and will reach a price of less than 10 Cents per GB by the end of the year.

Average contract prices for 512GB and 1TB SSDs have a chance to plunge below US$0.1 per GB by the end of this year, hitting an all-time low. This change will cause 512GB SSDs to replace their 128GB counterparts and become market mainstream, second only to 256GB SSDs. We may also look forward to PCIe SSDs achieving 50% market penetration, since PCIe SSDs and SATA SSDS are nearly identical in price.

TrendForce points out that SSD adoption among notebooks had already come above the 50% threshold in 2018. Contract prices for mainstream 128/256/512GB SSDs have fallen a long way by over 50% since peaking in 2017, and those for 512GB and 1TB SSDs have a chance to fall below US$0.1 per GB by year-end. This will stimulate demand from those seeking to replace their 500GB and 1TB HDDs. SSD adoption rate is expected to land between 60 and 65% in 2019.

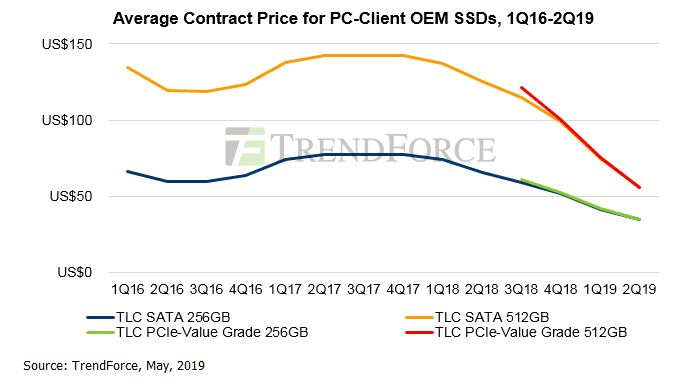

2Q Average Contract Prices for SSDs to Fall by Double Digits, May Drop by Less in 3Q

According to TrendForce's latest investigations, 2Q19 marks the 6th consecutive quarter of average contract price decline for mainstream PC-Client OEM SSDs, with the average contract price for SATA SSDs falling QoQ by 15-26%, and PCIe SSDs by 16-37 %.

The reasons for the continuous price fall in 2Q include: weakened stocking momentum due to the cautious stance of PC, smartphones, servers/datacenters OEMs towards end market sales and high inventory levels, leading to an overly oversupplied NAND flash market; prices wars by leading SSD suppliers who are keen to get their 64/72-layer stocks off their hands; and the price comparison effect as a result of Intel 3D QLC SSDs.

The demand side will be helped by the traditional peak season and increased stocking demand from the new Apple devices, possibly seeing an improvement over 1H in 3Q looking forward. Furthermore, many NAND flash suppliers are slowing expansion plans and have declared reductions in production to curtail supply. Yet judging from the rather high inventories along this chain of industry, TrendForce predicts that average contract prices for mainstream SSD capacities will likely continue their descent, although with a slope less steep.

Price Differences Greatly Narrow, with PCIe to Replace SATA Interfaces as Market Mainstream

Judging from the product progress of each SSD supplier, all mainstream product lines have already switched to 64/72 layer SSDs with 256/512GB capacities and PCIe interfaces as their main products. The newest 96-layer SSD has also gradually entered production in 1Q this year. Additionally, judging from average contract prices in the second quarter, current prices for Premium PCIe SSDs and SATA SSDs only differ by under 6%, while value grade PCIe SSDs and SATA SSDs register a nearly 0% difference. PCIe interfaces, with the help of value grade PCIe SSDs, will replace SATA interfaces to become market mainstream this year

Prices of 512 GB SSDs will drop below $ 0.1 per GB by the end of the year