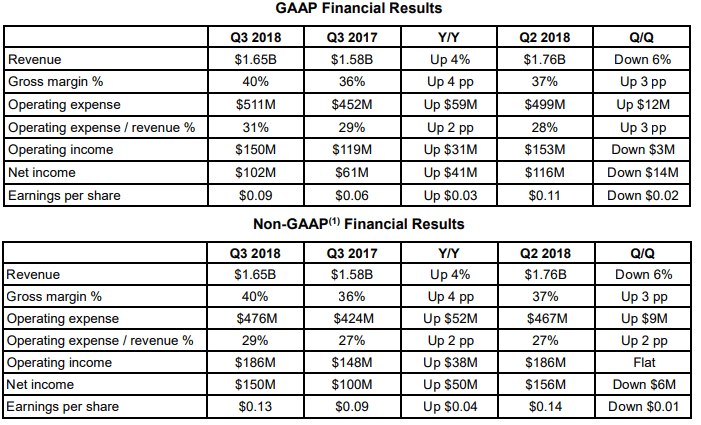

AMD (NASDAQ:AMD) today announced revenue for the third quarter of 2018 of $1.65 billion, operating income of $150 million, net income of $102 million and diluted earnings per share of $0.09. On a non-GAAP1 basis, operating income was $186 million, net income was $150 million and diluted earnings per share was $0.13.

"We delivered our fifth straight quarter of year-over-year revenue and net income growth driven largely by the accelerated adoption of our Ryzen, EPYC and datacenter graphics products," said Dr. Lisa Su, AMD president and CEO. "Client and server processor sales increased significantly although graphics channel sales were lower in the quarter. Looking forward, we believe we are well positioned for further market share gains as we continue making significant progress towards our long-term financial targets."

Q3 2018 Results:

- Revenue was $1.65 billion, up 4 percent year-over-year and down 6 percent quarter-over-quarter. The year-over-year increase was driven by higher client revenue in the Computing and Graphics business segment. The sequential decrease was driven by lower graphics revenue in the Computing and Graphics business segment. Third quarter revenue included IP-related revenue, of which $86 million was related to our THATIC joint venture. Third quarter 2017 revenue also included IP-related revenue.

- Gross margin grew to 40 percent, up 4 percentage points year-over-year, primarily driven by the ramp of new products, including RyzenTM and EPYCTM processors. On a sequential basis, gross margin was up 3 percentage points primarily driven by IP-related revenue and the ramp of new products. Excluding IP-related revenue and memory and inventory related adjustments, gross margin would have been 2 percentage points lower.

- On a GAAP basis, operating income was $150 million compared to operating income of $119 million a year ago and $153 million in the prior quarter.

- Net income was $102 million compared to net income of $61 million a year ago and $116 million in the prior quarter. Diluted earnings per share was $0.09, compared to diluted earnings per share of $0.06 a year ago and $0.11 in the prior quarter.

- On a non-GAAP basis, operating income was $186 million compared to operating income of $148 million a year ago and $186 million in the prior quarter.

- Non-GAAP net income was $150 million compared to net income of $100 million a year ago and $156 million in the prior quarter. Non-GAAP diluted earnings per share was $0.13, compared to diluted earnings per share of $0.09 a year ago and $0.14 in the prior quarter.

- Cash, cash equivalents and marketable securities were $1.06 billion at the end of the quarter.

- Cash flow from operating activities was $95 million as compared to $66 million a year ago. Free cash flow was $62 million, up from $32 million a year ago.

Quarterly Financial Segment Summary:

- Computing and Graphics segment revenue was $938 million, up 12 percent year-over-year and down 14 percent quarter-over-quarter. Year-over-year revenue growth was primarily driven by strong sales of Ryzen desktop and mobile products, partially offset by lower graphics revenue. Blockchain-related GPU sales in the third quarter were negligible. In the third quarter of 2017, blockchain-related GPU sales were approximately high single digit percentage of total AMD revenue. The quarter-over-quarter decline was due to significantly lower graphics revenue driven by high channel inventory, partially offset by higher Ryzen processor revenue.

- Client processor average selling price (ASP) was higher year-over-year and quarter-over-quarter primarily due to higher desktop and mobile processor ASP.

- GPU ASP decreased year-over-year and quarter-over-quarter due to lower GPU channel sales.

- Operating income was $100 million, compared to operating income of $73 million a year ago and operating income of $117 million in the prior quarter. The year-over-year operating income improvement was primarily driven by a richer client product mix and IP-related revenue, partially offset by lower graphics revenue. The quarter-over-quarter operating income decline was primarily due to lower graphics revenue.

- Enterprise, Embedded and Semi-Custom segment revenue was $715 million, down 5 percent year-over-year and up 7 percent quarter-over-quarter. The year-over-year revenue decrease was driven primarily by lower semi-custom product and IP-related revenue, partially offset by higher server sales. The quarter-over-quarter increase was primarily driven by higher semi-custom, IP-related and server revenue.

- Operating income was $86 million, compared to operating income of $74 million a year ago and $69 million in the prior quarter. The year-over-year increase was primarily due to a richer server and semi-custom product mix. The quarter-over-quarter increase was primarily due to IP-related and server revenue.

- All Other operating loss was $36 million compared with operating losses of $28 million a year ago and $33 million in the prior quarter.

Recent PR Highlights:

- AMD EPYC datacenter processor adoption continues to accelerate, with new platforms and deployments from several industry leaders showcasing the performance and value EPYC processors bring to a variety of workloads:

- Microsoft announced a new Azure H-Series cloud instance for high performance computing workloads powered by AMD EPYC processors.

- Dropbox announced that it will leverage AMD EPYC 7351P one-socket processor platforms to support future growth and refresh its existing infrastructure for its most demanding compute workloads.

- Xilinx revealed a new world-record for inference throughput of 30,000 images per-second, achieved by a system using two AMD EPYC 7551 CPUs alongside eight Xilinx Alveo U250 acceleration cards.

- Oracle announced the launch of multiple new AMD EPYC-powered service instances on Oracle Cloud Infrastructure that offer significant TCO and performance advantages for general purpose cloud computing workloads and popular Oracle applications.

- AMD expanded its client compute product portfolio with new high-performance desktop processors spanning from high-end desktop to entry-level:

- AMD launched its 2nd Generation AMD RyzenTM ThreadripperTM processors including a new WX Series for professional computing and improved X Series for enthusiasts and gamers. The Ryzen Threadripper 2990 WX processor is the world's most powerful desktop processor, delivering up to 53 percent faster multi-thread performance than the competition.

- AMD introduced its first "Zen" core-based AMD AthlonTM and Athlon PRO desktop processors, bringing the combined power of the high-performance "Zen" and "Vega" architectures to its entry-level consumer and commercial desktop processing product line-ups. The AMD Athlon 200GE consumer desktop processor delivers up to 67 percent more GPU performance and up to 2X greater power efficiency than the competition.

- AMD continues to enable state-of-the-art visualization and virtualization with powerful professional graphics solutions:

- AMD introduced the Radeon Pro WX 8200 graphics card, delivering the world's best workstation graphics performance for under $1,000 for real-time visualization, VR and photorealistic rendering.

- AMD introduced the Radeon Pro V340 graphics card, a high-performance dual-GPU Virtual Desktop Infrastructure (VDI) solution. The "Vega" architecture-based graphics card is purpose-built to power and accelerate the most demanding datacenter virtualization workloads.

Current Outlook:

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the fourth quarter of 2018, AMD expects revenue to be approximately $1.45 billion, plus or minus $50 million, an increase of approximately 8 percent year-over-year, and non-GAAP gross margin to increase to approximately 41 percent, driven by sales growth of Ryzen, EPYC and datacenter GPU processor sales. For comparative purposes, Q4 2017 revenue was $1.34 billion, adjusted for the ASC 606 revenue accounting standard, and included blockchain-related GPU sales of approximately low double-digit percent of overall AMD revenue.