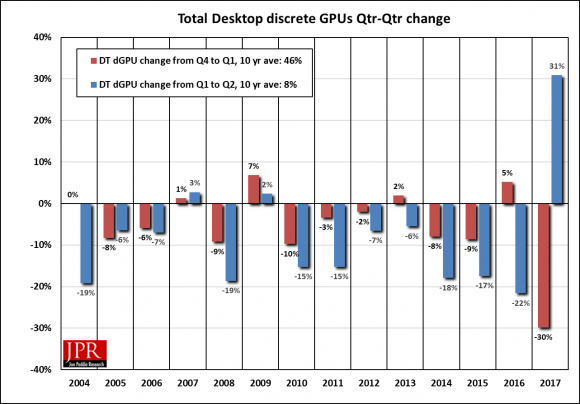

A new survey from JPR reveals that mining is booming business for companies that sell graphics cards. Both AMD and Nvidia have profited from the extra sales, up-to 31% compared over a range of ten years and still a good 7% from even last quarter.

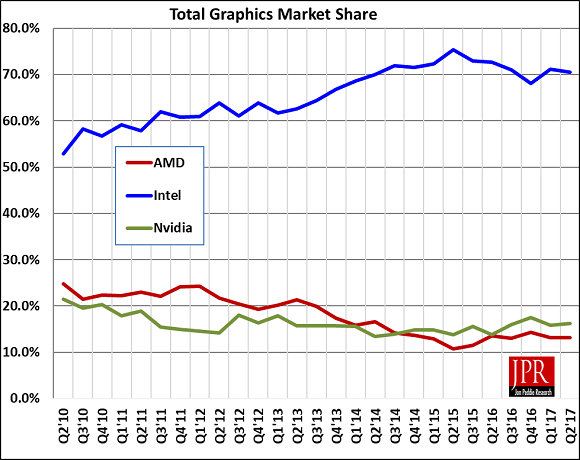

Nvidia is doing better in absolute numbers compared to AMD, who for whatever reason cannot keep up with demand as the figures show. It’s not good news for consumers / gamers as the risen demand in graphics card have caused shortages, which on their end increased pricing. For the first time in 20 years the units of sold dedicated graphics cards have risen.

As JPR writes: the chart shows, this is the first time in over 20 years that Q2 has seen an increase in shipments, and never one this dramatic. The big difference is the impact Bitcoin, Ethereum and other coin miners are having on the market. Why Ethereum? There was a similar uptick in GPU sales for Bitcoin and Litcoin mining 2013. It drove up sales of GPUs and especially AMD GPUs because of AMD’s GCN architecture favored mining. Low cost application specific integrated circuits (ASICs) were then employed to do the job and that boom went bust, much to the relief of gamers looking for better deals on GPUs. Bitcoin miners who had built large GPU structures for mining, dumped their AIBs on eBay, cannibalizing the GPU market for a couple of quarters. Due to the architecture of Ethereum, that won’t happen.

Ethereum uses a different hashing algorithm to Bitcoin, which makes it incompatible with the special hashing hardware, ASICs, developed for Bitcoin mining. Ethereum’s algorithm is known as Ethash. It’s a memory-hard algorithm; meaning it’s designed to resist the development of Ethereum-mining ASICs. Instead, Ethash is deliberately best-suited to GPU-mining. As long as Bitcoin process keep going up, new people will be attracted to the mining market. It will eventually flatten out because the ROI just won’t be there. At that point AIB sales for mining will roll off, and we may even see some dumping by the marginal players/miners. And there still is the social issue of what kinds of transactions the miners are verifying. Overall GPU shipments increased 7.2% from last quarter, AMD increased 8% Nvidia increased 10% and Intel, increased 6%. Year-to-year total GPU shipments increased 6.4%, desktop graphics increased 5%, notebooks increased 7%. After years of incursion into the discrete GPU market, it appears the discrete GPUs (dGPU) are gaining market share over iGPUs. The long-term CAGR has been positive, while iGPUs have been negative.

However, some of the increase in dGPU sales has to be attributed to the blockchain mining demand for GPUs. The continued decline in the overall PC market shows up in the integrated GPU shipment numbers, JPR concludes.

31% more Graphics Cards Sold Thanks to Mining