In a report published by Jon Peddie Research overall GPU shipments in the fourth quarter of 2017 decreased -1.5% from last quarter, however, the reports denotes that more than three million video cards have been sold to crypto miners in 2017, making AMD and Nvidia about $776 million.

It is also mentioned that the prices of video cards will not decrease short term, which in fact has recently been confirmed by Nvidia over at Massdrop. Prices would continue to rise during the second and third quarters, according to Nvidia. The shortage contributes to this.

-- JPR --

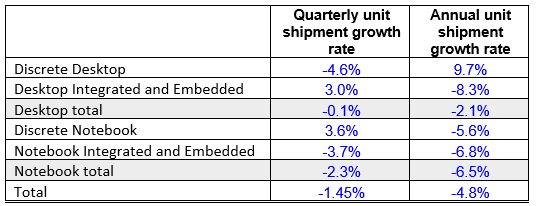

YEAR-TO-YEAR TOTAL GPU SHIPMENTS DECREASED -4.8%

Jon Peddie Research the industry’s market research firm reported that overall GPU shipments in the fourth quarter of 2017 decreased -1.5% from last quarter following normal seasonal shipments. Year-to-year total GPU shipments decreased -4.8%, desktop graphics decreased -2%, notebooks decreased -7%. Over 363 graphics units shipped in 2017.

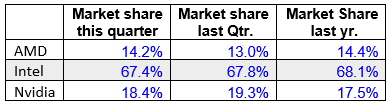

AMD increased its market share 8.1%, Nvidia decreased -6%, and Intel decreased -2%.

| Table 1: Graphics Chip Market shares |

Over three million add-in boards (AIBs) were sold to cryptocurrency miners worth $776 million in 2017. AMD was the primary benefactor of those sales.

| Table 2: Graphics Chip Market |

The fourth quarter is typically flat to slightly up from the previous quarter in the seasonal cycles of the past. For Q4'17, it decreased -1.5% from last quarter and was above the ten-year average of -3.40%.

“Gaming has been and will continue to be the primary driver for GPU sales, augmented by the demand from cryptocurrency miners.,” said Dr. Jon Peddie, President of Jon Peddie research. We expect demand to slacken from the miners as margins drop in response increasingly utilities costs and supply and demand forces that drive up AIB prices. Gamers can offset those costs by mining when not gaming, but prices will not drop in the near future.”

Quick highlights

- AMD’s overall unit shipments increased 8.08% quarter-to-quarter, Intel’s total shipments decreased -1.98% from last quarter, and Nvidia’s decreased -6.00%.

- The attach rate of GPUs (includes integrated and discrete GPUs) to PCs for the quarter was 134% which was down -10.06% from last quarter.

- Discrete GPUs were in 36.88% of PCs, which is down -2.67%.

- The overall PC market increased 5.93% quarter-to-quarter, and decreased -0.15% year-to-year.

- Desktop graphics add-in boards (AIBs) that use discrete GPUs decreased -4.62% from last quarter.

- Q4'17 saw no change in tablet shipments from last quarter.

GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it is shipped, and most of the PC vendors are guiding cautiously for Q1’18. Findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks). It does not include iPad and Android-based tablets, or ARM-based Servers, or x86-based servers. It does include x86-based tablets, Chromebooks, and embedded systems.

GPUs are traditionally a leading indicator of the market, since a GPU goes into every non-server system before it is shipped, and most of the PC vendors are guiding cautiously for Q4’14. The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in the quarter.

For those who wish to understand the PC market, an understanding of the highly complex technology and ecosystem that has been built around the GPU is essential to understanding the market’s future directions.

The report contains the following content:

- Worldwide GPU and PC Shipment Volume, 1994 to 2020.

- Detailed worldwide GPU Shipment Volume, 1Q 2001 to 2Q 2016, and forecast to 2020.

- Major suppliers: Detailed market share data-on the shipments of AMD, Intel, Nvidia, and others.

- Financial results for the leading suppliers: Analysis of the quarterly results of the leading GPU suppliers

- Market Forecasts: You will also be able to download a detailed spreadsheet and supporting charts that project the supplier’s shipments over the period 2001 to 2018. Projections are split into platforms and GPU type.

- GPUs: History, Status, and Analysis.

- Financial History from for the last nine quarter: Based on historic SEC filings, you can see current and historical sales and profit results of the leading suppliers.

- A Vision of the future: Building upon a solid foundation of facts, data and sober analysis, this section pulls together all of the report's findings and paints a vivid picture of where the PC graphics market is headed.

- Charts, graphics, tables and more: Included with this report is an Excel workbook. It contains the data we used to create the charts in this report. The workbook has the charts and supplemental information.

Three million add-in boards (AIBs) were sold to cryptocurrency miners in 2017